When is a ‘Bankable’ Document Bankable? – Part 2

Read part one of this article here.

In writing up the business case it is important to anticipate the kind of questions banks will ask in order to evaluate risks. In a cement project, for example, it would not be enough to simply point at locations on a map from which the primary and secondary raw materials will be sourced. Banks would want to know:

- Who owns these deposits and, if not owned by the investor, are there acceptable leasing agreements in place and, if so, what are the terms and conditions?

- Have the deposits been surveyed and tested to an acceptable degree of thoroughness by a reputable professional firm and have consultants certified that the raw materials can be converted into cements acceptable to the market?

- Is there a plan to transport raw materials to the cement plant and have all costs (e.g. new roads, conveyors) associated with this plan been included in the capital cost estimate?

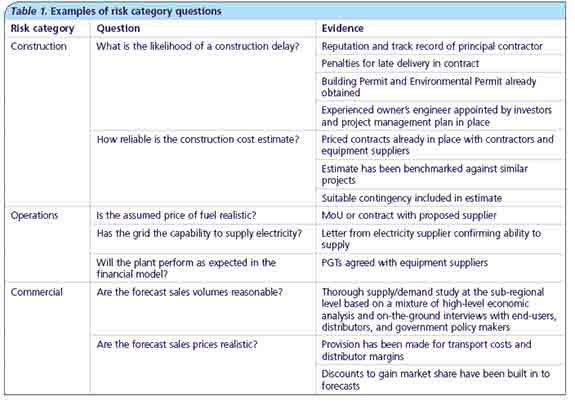

Table 1 sets out some examples of the questions in each risk category that banks will expect to be addressed in a Bankable Document – together with the evidence that could be presented in support of the answers.

In some cases the ‘evidence’ can be provided early in the process (e.g. the market study), but in many cases it is necessary to wait until the project has reached an advanced stage of development – for example, the capital cost can only be firmed up once design specifications have been produced and circulated and priced tenders from suppliers and contractors have been received. For this reason it is advisable to consider the Feasibility Study as a ‘living document’, to be updated gradually as the project moves forward. Consultants can guide investors through the process and advise on both the issues that are likely to be raised by banks and the documentary evidence that would be helpful in supporting the business case.

Four reasons to use consultants for your Bankable Study

- While owners may prepare only one Bankable Study in a career, experienced consultants will have dozens under their belt.

- Consultants are more used to dealing with banks and other stakeholders, such as export credit agencies, and are therefore better prepared to produce what they expect.

- Banks will use their own consultants to conduct due diligence on projects. Consultants understand what they will be looking for and how to address their concerns.

- Consultants are not invested in projects; they are in a stronger position to stand back and take a hard look at projects, so identifying and addressing what banks will consider to be the main risks.

Independent Cement Consultants has many years’ experience of advising both investors and financial institutions on greenfield and brownfield investments in the cement sector, with a capability including raw materials, environment, logistics, design and technology, operations, markets, and financial analysis.

This is part two of a two-part article written by Paul Wellings, Independent Cement Consultants, for World Cement’s August issue and abridged for the website. Subscribers can read the full issue by signing in, and can also catch upon-the-go via our new app for Apple and Android. Non-subscribers can access a preview of the August 2015 issue here.

Read the article online at: https://www.worldcement.com/special-reports/18082015/when-is-a-bankable-document-bankable-part-2-331/

You might also like

The World Cement Podcast - CleanTech & Venture Capital

Our guest for this episode of the World Cement Podcast is Alfredo Carrato, Venture Capital Advisor for CEMEX Ventures. Listen in to the conversation as World Cement's Senior Editor, David Bizley, and Alfredo discuss the role of venture capital and cleantech in enabling the cement industry's green transition.

Tune in to the World Cement Podcast on your favourite podcast app today.